Search

Search WelcomeWelcome Login

WelcomeWelcome LoginFebruary 23, 2023

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. People often discover tax identity theft when they file their tax returns. Taking steps to protect your personal information can help you avoid tax identity theft. Here’s what you can do to stay ahead of identity thieves.

Protect documents that have personal information

Keep your tax records and Social Security card in a safe place. When you decide to get rid of your tax records, shred them. If you don’t have a shredder, look for a local shred day.

Protect your information from scammers online

If you use tax preparation software like TurboTax, TaxAct, or TaxSlayer, use multi-factor authentication. Multi-factor authentication offers extra security by requiring two or more credentials to log in to your account. The additional credentials you need to log in to your account fall into two categories: something you have — like a passcode you get via text message or an authentication app, or something you are — like a scan of your fingerprint, your retina, or your face. Multi-factor authentication makes it harder for scammers to log in to your accounts if they do get your username and password.

Beware of IRS impersonators

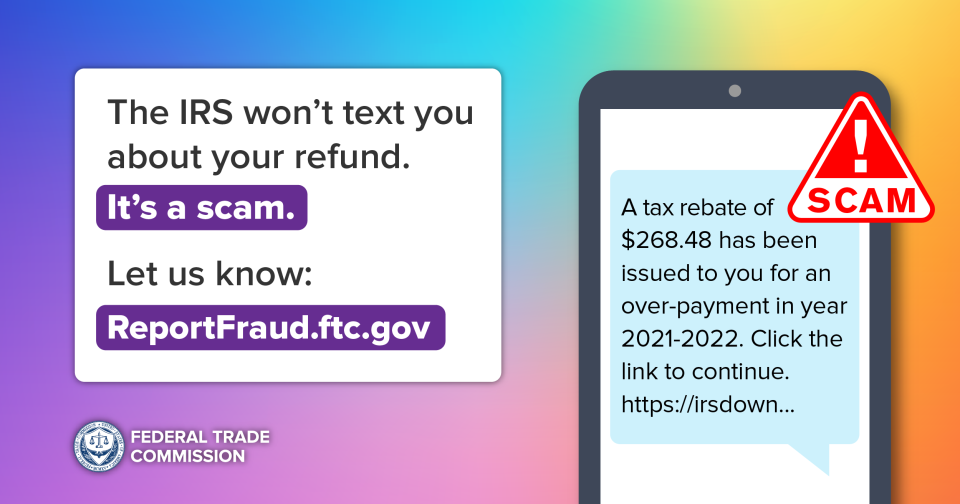

Don’t give your personal information to someone who calls, emails, or texts and says they’re with the IRS. It could be a scammer impersonating the IRS to steal your information or money. If you need to contact the IRS, call them at 1-800-829-1040.

IRS impersonators have been around for a while. But as more people get to know their tricks, they’re switching it up. So instead of contacting you about a tax debt and making threats to get you to pay up, scammers may send you a text about a “tax rebate” or some other tax refund or benefit.

The text messages may look legit, and mention a “tax rebate” or “refund payment.” But no matter what the text says, it’s a scammer phishing for your information. And if you click on the link to claim “your refund,” you’re exposing yourself to identity theft or malware that the scammer could install on your phone.

If someone contacts you about a tax rebate or refund:

If you clicked a link in one of these text or emails and shared personal information, file a report at IdentityTheft.gov to get a customized recovery plan based on what information you shared.

Source: https://consumer.ftc.gov/articles/what-know-about-tax-identity-theft